All businesses are held to certain standards when it comes to records management. Sometimes, regulations are in the form of industry-specific retention standards produced by governing bodies within that industry. Other times, laws passed at local, state, or federal levels can change the calculus of records management in an industry or across the broader business landscape. One example is the Sarbanes-Oxley Act, a broadly tailored piece of federal legislation that reshaped records practices across many industries.

A Brief History of the Sarbanes-Oxley Act

The Sarbanes-Oxley Act, or “SOX” as it’s informally known, is complex and covers a variety of issues relating to financial transparency and ensuring shareholder protection. How it relates to records management practices is straightforward. It underscores the importance of an effective records management system for all businesses, both for ensuring compliance and protecting stakeholder interests.

The Sarbanes-Oxley Act was signed into law by President George W. Bush in 2002, after passing in both the House of Representatives and the Senate by near-unanimous margins. Signed into law in the wake of multiple high-profile cases of fraud, including the 2001 Enron scandal. The Act is aimed at preventing financial malpractice through ensuring the accuracy of consistently produced financial statements.

SOX: How does it work?

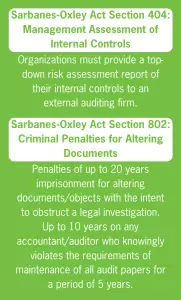

“SOX” is the most famous for Section 404. This section requires that companies implement internal controls to improve and maintain their ability to produce accurate financial statements. This is the most impactful way in which the Sarbanes-Oxley Act impacts businesses. Section 404 is what people are often thinking of when referring to the Sarbanes-Oxley Act. This section is a key part of how the legislation works. It underscores the importance of good records management practices, since all companies are at risk of penalties for non-compliance.

Also, the “SOX” directly enforces document retention, through standards outlined in Section 802. This section requires accountants that review company financial statements to retain those records for a minimum of five years.

The Sarbanes-Oxley Act and Records Management

A thorough, effective records management system is a necessary part of Sarbanes-Oxley Act compliance. While some aspects of it speak directly to retention practices and standards, staying compliant with all tenets of “SOX” requires an organized records management system for efficient production of stored records. Contact Secure Records Solutions to learn more about a records management plan that helps you stay compliant with legislation like the Sarbanes-Oxley Act while meeting the unique needs of your business.